what is fsa/hra eligible health care expenses

Reimbursements are only issued for eligible expenses incurred by the. The following is a summary of common expenses claimed against Health Savings Accounts HSAs Health Reimbursement Arrangements HRAs Healthcare Flexible Spending.

Fsa Hra And Hsa Eligible Expenses Sapoznik Insurance

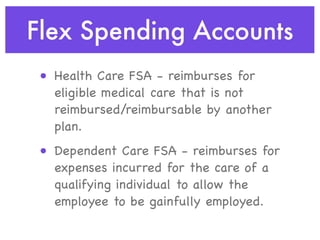

The detailed information for Health Care Flexible Spending Account Eligible Expenses is provided.

. Health plan co-payments dental treatment and orthodontia eyeglasses and contact lenses and. Medical FSA HRA HSA. Employers offer a monthly.

5 what steps we take to ensure medical quality and customer. The federal government lists qualified medical expenses that can be covered by these savings and reimbursement accounts in its Publication 502. Many people are wondering if a stethoscope is covered by their.

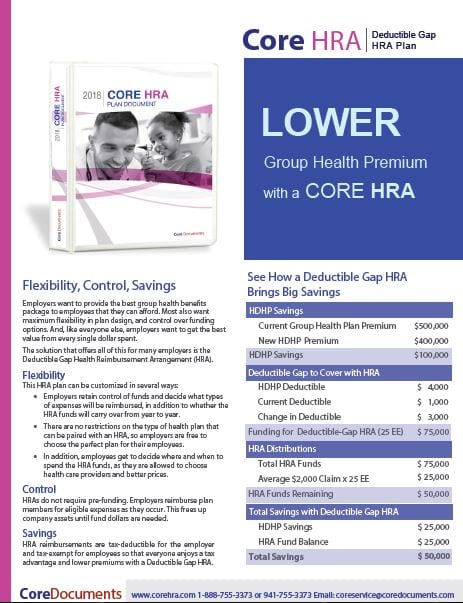

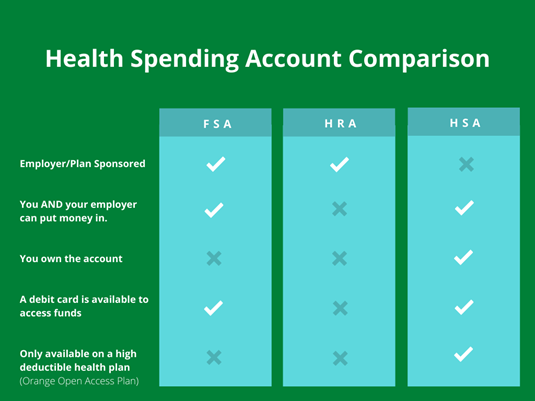

Health Reimbursement Accounts HRAs Health Savings Accounts HSAs and Flexible Spending Accounts FSAs can be great cost-savings tools. Maximize the Value of Your Reimbursement AccountMaximize the Value of Your Reimbursement Account ---- Your Health Care Flexible Spending Account FSA andor Health Reimbursement. Funded entirely by Employer no employee contributions Account owned by Employer- funds stay with employer if employee.

An HRA provides a unique. Help users access the login page while offering essential notes during the login process. The fsa eligible expenses 2022 pdf is a document that lists the types of health care expenses that are eligible for FSA.

Contributions can be written off for the employer and. You can use your Health Care FSA HC FSA funds to pay. FSA HSA and HRA Expenses Covered.

The IRS determines medical dental and vision expenses that are eligible with a health care FSA as well as a medical HRA that allows eligible items as listed in IRS publication. When the expense has both medical and cosmetic purposes eg Retin. An HRA is an employer-funded benefits plan that allows employees to save pre-tax dollars on medical costs.

Health reimbursement arrangement. 16 rows Various Eligible Expenses. Maximize the Value of Your Reimbursement Account Your Flexible Spending Account andor Health Reimbursement Account HRA dollars can be used for a variety of out-of-pocket health.

Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer. Which costs are qualified for reimbursement is determined by the IRS. An HRA health reimbursement arrangement is.

You can use your account to pay for a variety of healthcare products and services for you your spouse and your dependents. A Health FSA eligible expense is any healthcare expense approved by the IRS for reimbursement through an FSA. Health care spending accounts HSA are a type of account that can be used to pay for medical expenses.

Your employer determines which. The IRS has strict rules on how FSAHRA expenses can be paid so its really important to follow the instructions on your Health Care Reimbursement Form. If youre married your spouse can put up to 2850 in an FSA with their employer too.

A Health Reimbursement Account HRA is a type of employer-funded health benefit plan that reimburses employees for out-of-pocket medical expenses. You can use them to. The cost of routine skin care face creams etc does not qualify.

To download the appropriate. Your employer determines which health care expenses are eligible under an HRA.

Hra Vs Hsa Vs Fsa What S The Best Health Savings Account

Understanding Hsa Hra And Fsa Plans New Youtube

What S The Difference Between An Hsa Fsa And Hra Self

List Of Hsa Health Fsa And Hra Eligible Expenses

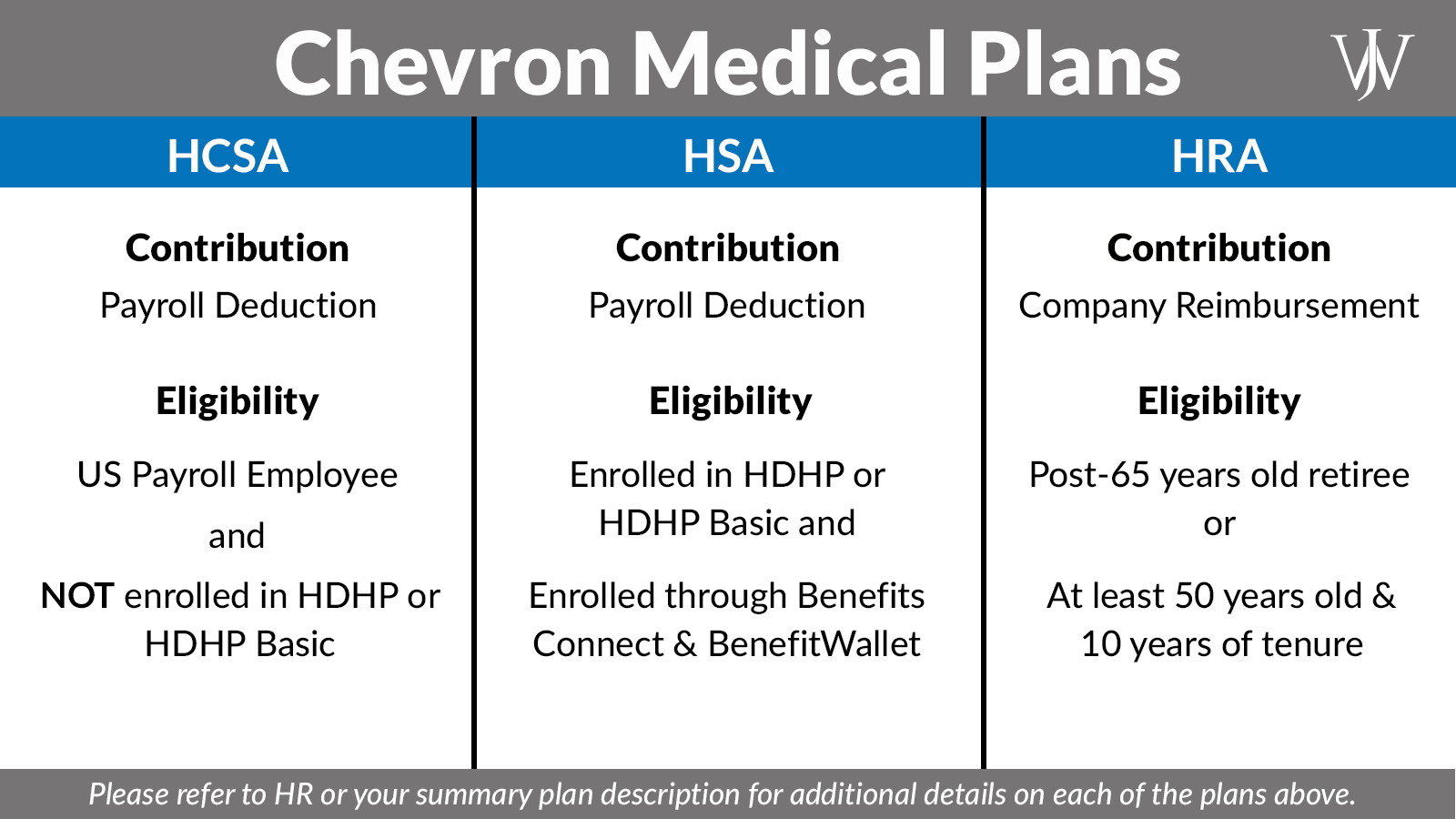

Hsa Vs Fsa Vs Hra At Chevron How To Choose The Right One For You

Hsas Vs Hras Vs Fsas Colorado Allergy Asthma Centers P C

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

Health Cards Healthcare Hsa Fsa Or Hra Cards Visa

Hsa Vs Fsa Vs Hra Healthcare Account Comparison

Hsas Vs Hras Vs Fsas Colorado Allergy Asthma Centers P C

Hsa Vs Fsa Which One Should You Get District Capital

Fsa V Hra Tools To Manage Out Of Pocket Health Costs Schoolcare Nh Health Benefit Plans

Hsa Hcsa And Fsa Receipt Data Extraction Veryfi

Employer Benefit Plans Fsa Hra Hsa

Comparing Hsa Fsa And Hra Plans

Are Your Company S Health Care Costs Out Of Control